Genius is releasing a series of Board Effectiveness articles, drawing on our own experiences as Board evaluators, of what impacts different Boards and what aspects of governance and people cause Boards to deliver more effectively as the leadership team of a business.

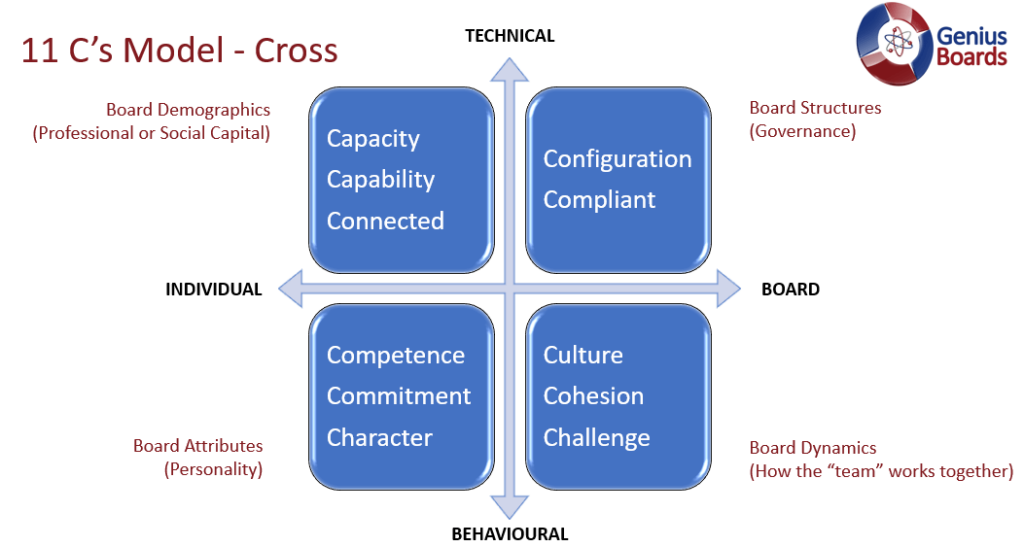

For the first phase, we shall use the 11 C’s Governance Model created by Jeremy Cross as a framework to discuss the many myriad of influences on the team and their ability to work effectively.

This week is the fourth part of a many week series of addressing some of the key elements of Board Effectiveness. We started first with Leadership, then addressed Structure, Demographics and Attributes from the 11 C’s Model. Now we shall address Board Dynamics.

Next, the series will address some of the issues raised, particularly in Dynamics, in more detail – for example, decision making, stakeholder conversations, strategic focus and the role of the Company Secretary.

Part One of Three Board Dynamics presented as three articles

In our previous weeks’ article series, Genius addressed “Board Structure”, “Board Demographics” “Board Attributes”, and their influences on Board effectiveness.

This week, Genius is addressing the three “Board Dynamics” topics of Culture, Cohesion and Challenge. I refer to these as the invisible influences and they are often are the most potent of all the influences on Board Effectiveness. Potentially easy to fix, but often exceedingly difficult to diagnose and the take ownership thereof.

To keep reading easy, only one of the three will be addressed a day.

Board Dynamics addresses, within the physical people appointed to the Board, their collective influence by the way they behave, and interact and how that collective impacts Board effectiveness. Many Directors will have experienced Boardrooms that are not rational places!

Culture

Whenever people are involved, things are not always simple and logical.

Anyone who has been on a Board will know that notwithstanding Structure, Demographics and Attributes being in place, something else is impacting the Board’s effectiveness. More recently, regulators, behaviour scientists, governance specialists and Boards are recognising that there is a team dynamic that plays out differently depending on who is present in the team.

Research indicates that board dynamics, the outcome of the team working together, is the most important predictor of profitability of a business. Therefore, time and effort invested in boardroom culture deliver a high return on investment.

It has been recognised by regulators and practitioners that the behaviours and dynamics in banks globally in the early 2000s culminated in the global 2008 Financial Crisis.

In this article, we shall delve into the issues of the unique aspects of a Board versus other teams, prevailing culture, possible sub-cultures and address desired and appropriate cultures.

A clear example of different cultures would be for example that of a successful private-owned fintech company and a listed FTSE 100 company. The first Board likely to be creative, agile and product-focused, the latter being governance and process led at Board level.

1. Boards are a unique team because –

A key risk to a Board’s effectiveness is the lack of hours spent together over a period of a year. For some Boards it can be as low as 4 meetings of 2 hours, resulting in only 8 hours working together as a team.

The top end of hours is likely to be a four-hour board meeting held monthly, still only delivering 48 hours a year of working together.

Today, in Spring 2020, there is the added dimension of working and meeting remotely due to COVID-19 increasing boardroom dynamic risks.

Boards are tasked with strategic decision making, working with limited and potentially filtered information and often with restricted timetables and many prevailing agendas. Their duty (in terms of S 172 or the Companies Act 2006 and UK Corporate Governance Code 2018) being to make the decision that is most right for the sustainable long term success of the business. This statement alluding to the fact that there is often not a clear right and wrong given the unknown future.

Another nuance is the responsibility of the Board, which is oversight and holding to account the management, a smaller group often of full-time executives of which 2 or maybe 3 usually are Board members.

As stated by Aristotle – “the whole is greater than the sum of the parts”.

You may know each Director of a Board and know how they think and behave on a one to one basis. When these known individuals are brought together, you will have no idea how they will collectively respond to different topics. The “pack” or team behaviour is not equal to the sum of everyone’s likely view.

Today, team coaching is seen to be more effective than one-to-one coaching, allowing all the dynamics to interact with the coaching input, giving, therefore “space” for individual coaching outcomes to be integrated by the team to support the individual’s growth.

2. Boards are not unique because –

They are a smaller group of people that have complementary skills and committed to a common purpose, for which they are accountable.

Board are not always that small but are a “limited” number of people within a team.

We drive for diversity on a Board, but there is a management to create complementary skills and experience.

The common purpose being the strategy, the goals, the plans, the objectives of the organisation.

The Board is accountable to its stakeholders and itself.

3. Prevailing Culture

a. Assess the current culture

To begin, it is important to understand the current culture within the Board. There are several Models that prevail to support this assessment that range from determining if the Board is a leader or follower, cohesive or lone ranger, procedural or strategic, informal or professional or addresses or avoids the difficult issues etc.

There are key roles, and therefore the people in those roles, that have a direct influence on the culture, primarily being the Chairman and the Company Secretary.

In a future article, we shall delve into more depth on the influences of these two roles.

b. Ethics

So, what does ethics mean? The most relevant definition states – “the moral principles that govern a person’s behaviour or the conducting of an activity”

In other words, the singular or collective moral compass by which a person or a team behave and make decisions.

A 2017 study on Barclays Bank post the LIBOR crisis indicates “the scandal of Barclays Bank depicted how organizations violate ethical behaviours and corporate social responsibilities.”

Stakeholders today focus on “doing the right thing” by the planet and people, and there is an expectation of social responsibility over profitability being a focus. This is complicated by investors short term investment decision making.

Ethical and social responsibility behaviour does play a critical role in stakeholder perception of products and the company.

c. Trust

Trust is an important component of Board effectiveness. If there is any breakdown in trust between any of the Board Directors, decision making and behaviour will be directly impacted, therefore undermining effectiveness.

If Directors do not trust the Chairman, for example, to listen to a point of view without their own agenda influencing them, they will be reluctant to put themselves in this risk position and will hold their thought rather than voicing it.

d. Performance

Is the Board supporting, and holding to account, the performance of the management and the company?

Is the business performing well, how well is it achieving its strategic objectives?

Is there a risk that due to good performance, the Board could become complacent, less incisive in its challenge or less focused on its decision making?

There is also the consideration of whether the Board is a “learning” Board, is it constantly aiming to improve its effectiveness?

As a business evolves from, for example, being a single owner to being a listed entity; how has the Board evolved and changed the way it operates to support the changes in the business’s life cycle?

4. Sub-cultures

On different Committees, there could be different cultures to that of the main Board. This too could develop on subsidiary Boards, holding company Boards or Executive Committee.

5. Appropriate Culture

There is no one prevailing “right” culture. There will be times, for example, where the culture needs to be more autocratic and others where it needs to be more consultative. There will be times when the focus needs to be on cashflow or profit to ensure business success and there will be other times where purpose will need to be the forefront for stakeholders.

What the Board, and particularly the Chairman, needs to determine is, what is the right culture now and for how long, before culture needs to be reassessed to continuously maximum effectiveness.

Conclusion

In conclusion, “culture” is the most difficult to assess from inside the Board and is usually more easily assessed by an outsider. This is the foundation for, in terms of best practice or regulated requirement, of having an external Board Evaluation every three years.

An external review allows the Board to be assessed through the eyes of an experienced outsider who can accurately and objectively reflect, on what the Board looks like, and how it collectively behaves.

Often the outcomes of a culture review are a surprise to the Chairman and the Board. In most cases, the changes needed are technically easy to achieve. Given it involves people to change, sometimes near impossible to achieve.