G

enius is releasing a series of Board Effectiveness articles, drawing on our own experiences as Board evaluators, of what impacts different Boards and what aspects of governance and people cause Boards to deliver more effectively as the leadership team of a business.

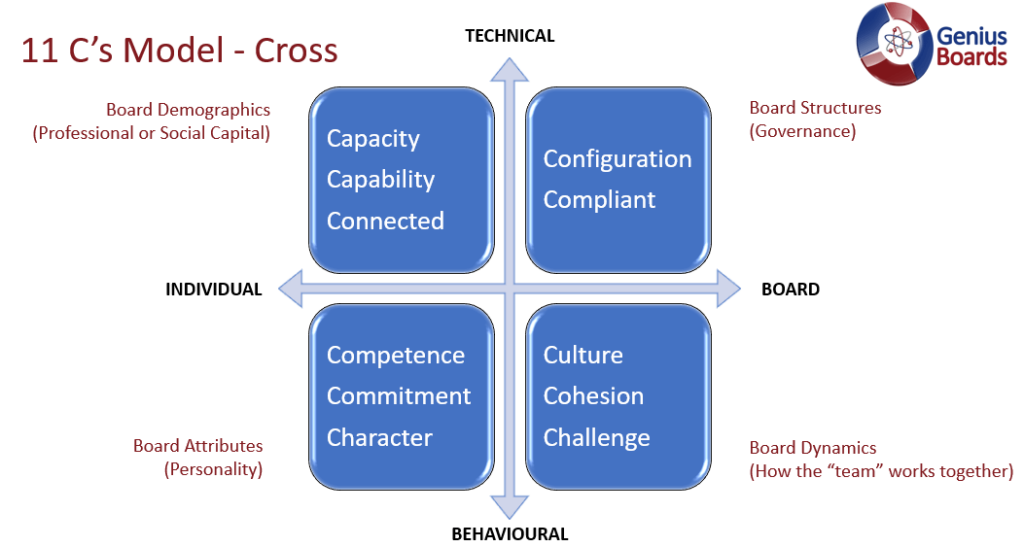

For the first phase, we shall use the 11 C’s Governance Model created by Jeremy Cross as a framework to discuss the many myriad of influences on the team and their ability to work effectively.

This week is the fourth part of a many week series of addressing some of the key elements of Board Effectiveness. We started first with Leadership, then addressed Structure, Demographics and Attributes from the 11 C’s Model. Now we shall address Board Dynamics. Next, the series will address some of the issues raised in particularly Dynamics in more detail – for example, decision making, stakeholder conversations, strategic focus and the role of the Company Secretary.

Part Two of Three Board Dynamics presented as three articles

In our previous weeks’ article series, Genius addressed “Board Structure”, “Board Demographics” “Board Attributes”, and their influences on Board effectiveness.

This week, Genius is addressing the three “Board Dynamics” topics of Culture, Cohesion and Challenge. I refer to these as the invisible influences and often are the most potent of all the influences on Board Effectiveness. Potentially easy to fix, but often exceedingly difficult to diagnose and the take ownership thereof.

To keep reading easy, only one of the three will be addressed a day.

Board Dynamics addresses, within the physical people appointed to the Board, their collective influence by the way they behave, and interact and how that collective impacts Board effectiveness. Many Directors will have experienced Boardrooms that are not rational places!

Cohesion

Cohesion is a double-edged sword. Too much and we have trouble, and too little and again we have trouble.

Imagine a Board that is so cohesive, there a consistent group think and what the Chairman or CEO state is what is “decided”.

Imagine a Board that has no cohesion, no alignment to a common goal and weak chairmanship, decision making will be difficult and drawn out.

Aligned to the cohesion continuum is assessment of risk. A Board that has ineffective cohesion will inevitably have weak risk maturity and alertness to existing and emerging risks. This is often because the risk antennae are that of one person, not that of the collective minds.

Another way to describe the ends of the continuum is “group think” risk where there is too much cohesion to “chaos” where there is no cohesion.

Let us review “cohesion” from several standpoints:

1. Collegiate

A Board can be collegiate and have optimum cohesion without the above risks prevailing.

Take, for example, a collegiate Board will readily embrace a new Director irrespective of their experience or diversity, making that person welcome and helping them learn the ropes.

A non-collegiate Board would view any change as personal risk, thereby often standing in the way of necessary change to retain optimum effectiveness.

2. Common focus

Where a Board is aligned on the strategy, the goals and the journey, there will be natural cohesion without undermining Director independence and challenge.

Where there are, for example, different personal agendas – CEO focused on rewards and KPI’s to maximise personal income, a Chairman focused on their reputation, a CFO focused on achieving the numbers at all costs – such a Board would have difficulty in having constructive, progressive, decision making conversations.

It is critically important that the Chairman is effective in all aspects of leadership otherwise the common focus could be impossible.

3. Ability to debate

There are many factors that impact effective debate. The most critical being whether the Chairman has created a “safe place” for all Directors to contribute to the conversation.

Another key factor, being the Directors capability and competence (covered in earlier articles) to have a voice and to raise their points of view effectively to the debate.

The third component is having enough knowledge on the topic within the room.

A fourth and often forgotten, enough business common sense to think logically and laterally and to challenge to the accepted norm by those “in the know”.

4. Involvement / Engagement / Contribution

It is important that the Directors “come to the party” and are –

- Involved in the business, take the trouble to understand the company, its drivers, the industry, the product, stakeholders and the team

- Engaged in the business and the Board between Board meetings, seeing where market activities can be of value if fed back to the business, responding to correspondence from the Board and key people in the organisation

- Contribute to debates when they have valued insights into the conversation, putting forward ideas to be considered, responding to conversation with knowledge and experience

There is a balance between a Director who is always mindful of the business and the value they can bring and be overly involved and interfering.

An easy way to determine the balance is “noses in, fingers out”.

5. Independence of Mind

Within cohesion, you require a Director to have their own viewpoints. There is no space on a Board for pack behaviour or groupthink.

It is difficult sometimes for a Director to retain independence of mind. A wonderful example was the film starring Henry Fonda, 12 Angry Men when a jury view of 11 to 1 became a unanimous agreement with the contrary view of the one jury member.

Independence of mind requires maturity of all Directors and competent leadership and mentoring from the Chairman to retain the effectiveness of debate and therefore effective decision making.

6. Completion

An important part of all Board activities is as a team, to complete the task at hand. This fosters further cohesion and reduces frustration or rogue behaviours. This is part of trust to get conclusion on each matter and hold the management to account on delivery – completing the action cycle to Board feedback.

7. Consensus

Consensus sounds like the holy grail for every Chairman and Director. Short, simple meetings, with no conflicting conversations and quick decisions as all agree. This is not effective governance.

The other side of the coin is where a Chairman will not allow progress until there is consensus. This wastes a lot of time and ultimately coerces the differing view to toe the line just to get a decision made – even when they have a full or partial disagreement.

It is preferable to work with the majority decision ensuring contrary views are accurately minuted. Those that disagreed with the decision are extremely valuable to the Chairman as they will be alert to the risks as the “project” progresses, and a source of insight the Chairman should constantly listen to.

Conclusion

In conclusion, cohesion is needed and has tremendous value, but under ineffective chairmanship could be a key driver for an ineffective Board.